New framework to conduct crypto-activities in the UAE

Publications Written by Marsel Shadmanov

UAE’s Fintech background

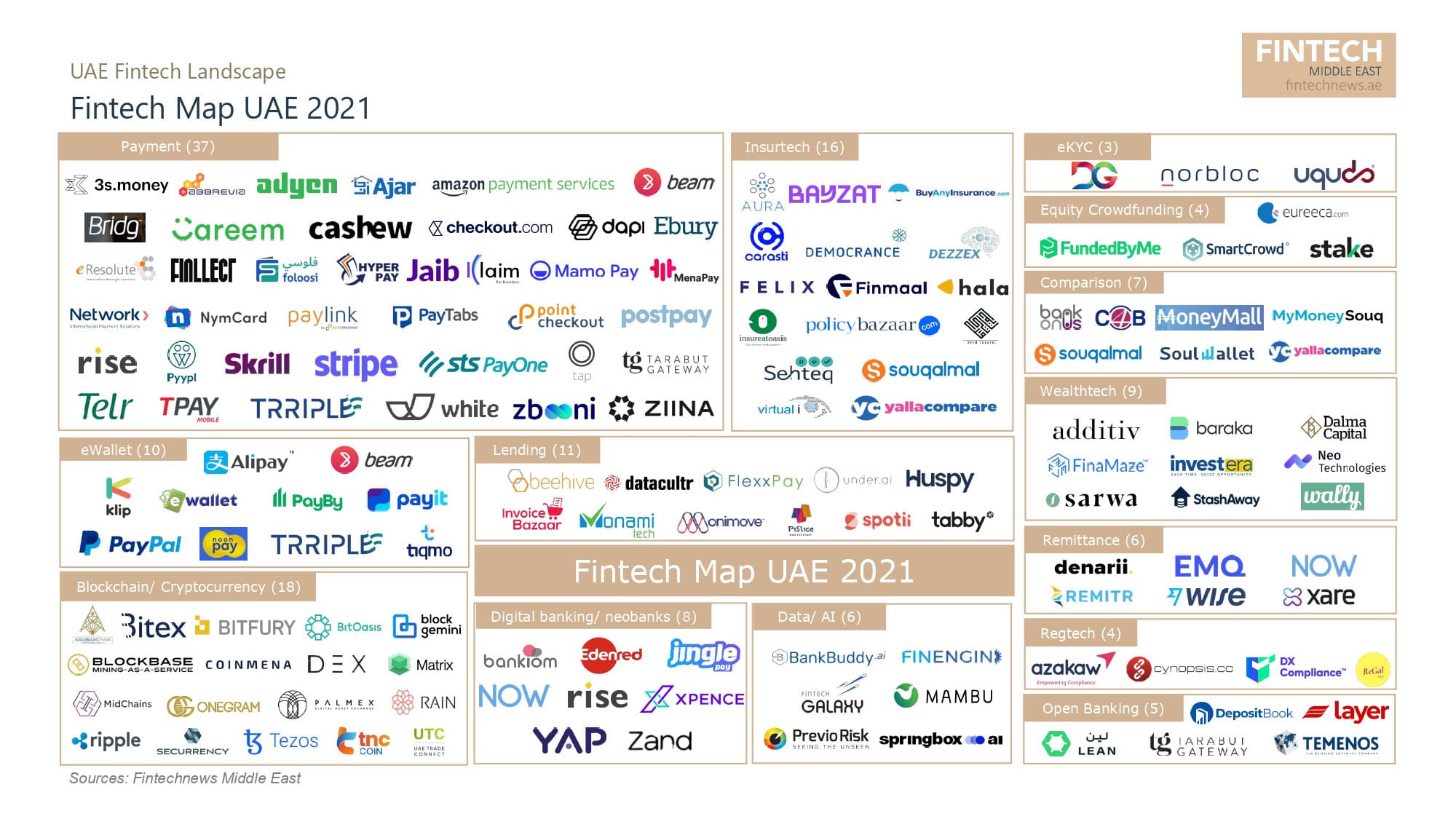

For the moment of publishing this article, approximately 4,5 % of the country’s GDP comprises transactions within the digital area, which implies crypto-transactions, such as blockchain, buying crypto-assets, etc. This amount is equivalent to AED 100 billion. According to the Fintech News Middle East, there are 134 fintech companies registered in the UAE by mid-2021. Several examples of key segments of these companies are e-wallet and blockchain/cryptocurrency.

The image below illustrates fintech companies for the mid-July 2021:

The source: Fintech News Middle East: UAE Fintech Report 2021

DWTC and SCA Agreement

Coming back to the Agreement between DWTC and SCA, it draws up a range of empowerments for DWTCA, associated with licensing and approving for operating financial activities within the crypto assets segment under DWTCA jurisdiction. In collaboration with SCA, the Free Zone will oversee such segments, as an offering, listing, and trading crypto assets, as we mentioned earlier. The framework is not the first concept concerning crypto transactions in the UAE. In June 2018 an international financial center and free zone of Abu Dhabi — Abu Dhabi Global Market (ADGM) adopted Virtual Asset Regulatory Framework, which includes the Rules and Requirements (including the Virtual Assets Guidance) that apply to Authorized Persons, who are conducting a Regulated Activity in a context of Virtual Assets.

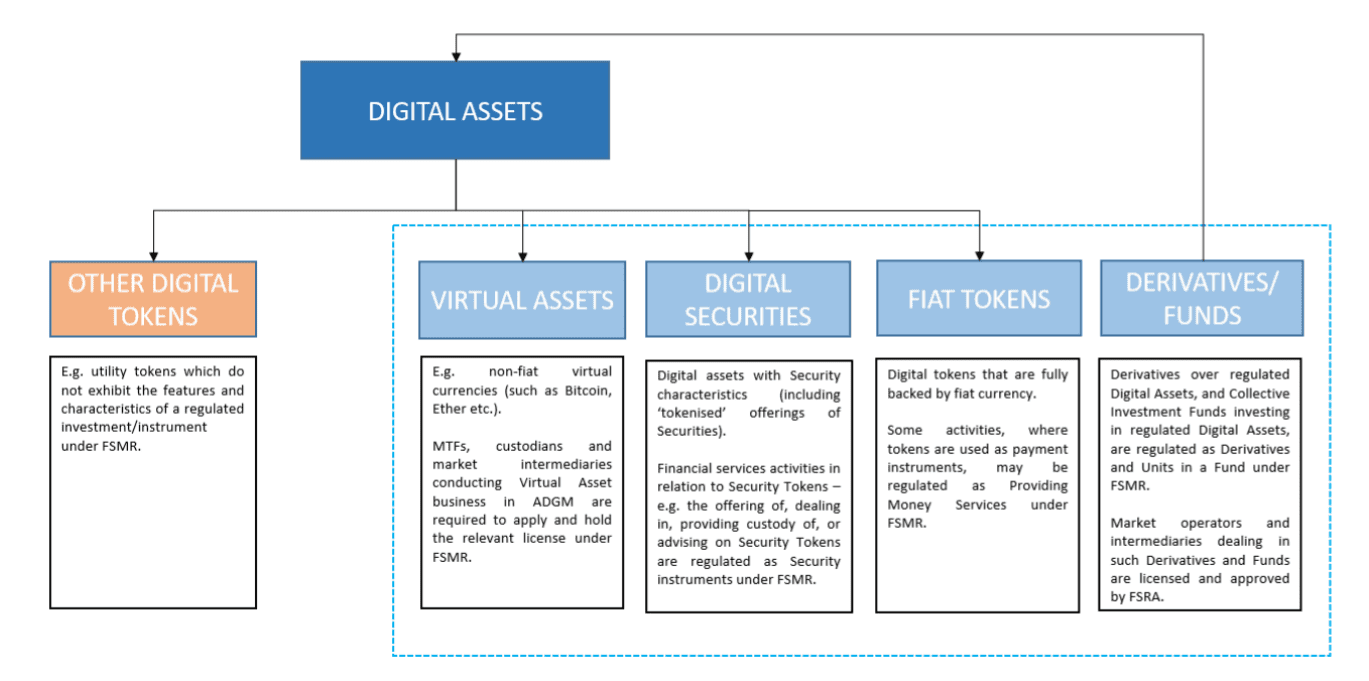

Considering a framework by ADGM, Digital Assets are composed of 5 categories of assets, each following its own regulatory approach. Virtual Asset, for instance, is defined as a digital form of valuable unit, which can be traded online as a means of exchange, a store of value, or a unit of account. Bitcoin and Ethereum are examples of Virtual Asset. It is important to note that the Virtual Asset is distinguished from e-money, and fiat currency. Moreover, for the moment of publishing this article, Virtual Asset is carrying its functions only within the agreement of a certain community and does not have legal status in any jurisdiction. ADGM is the example of a community, which authorizes carrying Regulated Activity concerning Virtual Assets. The Agreement between DWTC and SCA is another example of authorization of Regulated Activities, concerning Virtual Assets. Meanwhile, Cryptocurrencies, along with security tokens, utility coins, are all different types of crypto assets.

The image below illustrates 5 constituents of Digital Assets in the ADGM framework:

The source: Guidance – Regulation of Virtual Asset Activities in ADGM

Thus, the new Agreement between DWTC and SCA is intended to regulate transactions, mentioned above. The framework is yet to be defined. For instance, which components would be listed under crypto assets, is yet to be announced. As mentioned previously, Digital Assets, demonstrated in the ADGM framework, for instance, consist of 5 assets, which is demonstrated in the figure above. It was outlined that SCA will hold the responsibility to regulate the transactions, as well as to issue the licenses for companies under the jurisdiction of SCA and DWTC.

The terms to acquire the license are not announced yet. There might be a possibility that they will follow the licensing principles, listed in the ADGM framework in 2018. For instance, as per the framework, to be granted to conduct a regulated activity concerning Virtual Assets, the applicant company must meet the criteria listed in the requirements of the Financial Services Regulatory Authority (FSRA). In accordance with section 30 of Financial Services and Markets Regulations 2015, applicants who meet the requirements for permission to engage in a Regulated Activity will be issued a Financial Services Permission. Separately, it might be required to obtain approval from the FSRA, if relevant.

The Agreement, signed between SCA and DWTC might follow principles, similar to ADGM concepts in licensing and regulating the crypto-activities within jurisdictions of two Free Zones. Therefore, the new program is currently at the preliminary stage, with a developing framework. The Free Zones set the goal to exchange best practices and provide mutual technical support in a Fintech segment, as part of the collaboration, outlining both parties' responsibilities and obligations.

As the Director-General of the Free Zone concluded, DWTC is also looking for ways to create a long-term strategy for the cryptocurrency ecosystem as part of preparing for the future. The country is committed to being at the forefront of blockchain research and implementation, and the Treaty's goal is to strengthen that position.

If you would like advice or assistance concerning the fintech operations, kindly contact us.

Marsel Shadmanov

Head of Corporate Services at Garant Business Consultancy DMCC

Phone +971 4 421 4335

Email info@garant.ae