Filing Tax Returns and Refunds

For a VAT system to be successful in achieving its objective, having accurate VAT returns filed by the Taxable person is of utmost importance. That said, UAE laws envisage comparatively large penalties for non-filing of VAT returns and filing incorrect returns.

All VAT returns are to be submitted online using the FTA portal by the taxable or any other person authorized to do so on behalf of the taxable person.

Two types of returns can be filed depending on the nature of transactions undertaken by the taxable person:

- Tax return with Tax Payable for the period.

- Tax return with Tax refundable by the FTA for the period.

In cases where the taxes are refundable by the FTA, the taxable person has an option to carry forward the excess to the next tax period for offsetting the future period’s tax liability or to claim the excess as a refund. For claiming the excess tax as a refund an additional form for applying for Tax refund is to filled and submitted online to the FTA.

Tax returns should be prepared with utmost care, with special attention to the following:

- The amount of supplies received, covered by Reverse Charge Mechanism should not be ignored for the reason that it does not have financial implication on the final tax dues.

- The calculation of value of supplies should be as per the requirements of the VAT law.

- The transactions for which consideration is in non-monetary terms are often left out, since they do not have any actual monetary flow to be recorded in the books of accounts.

- The portal automatically fetches value of goods imported is from the UAE Customs. However, the adjustment to the value of imports on account of difference in exchange rates used by the Customs and the rate prescribed by the FTA in exercise of its powers conferred in the VAT legislation are to be made in the VAT return in appropriate fields.

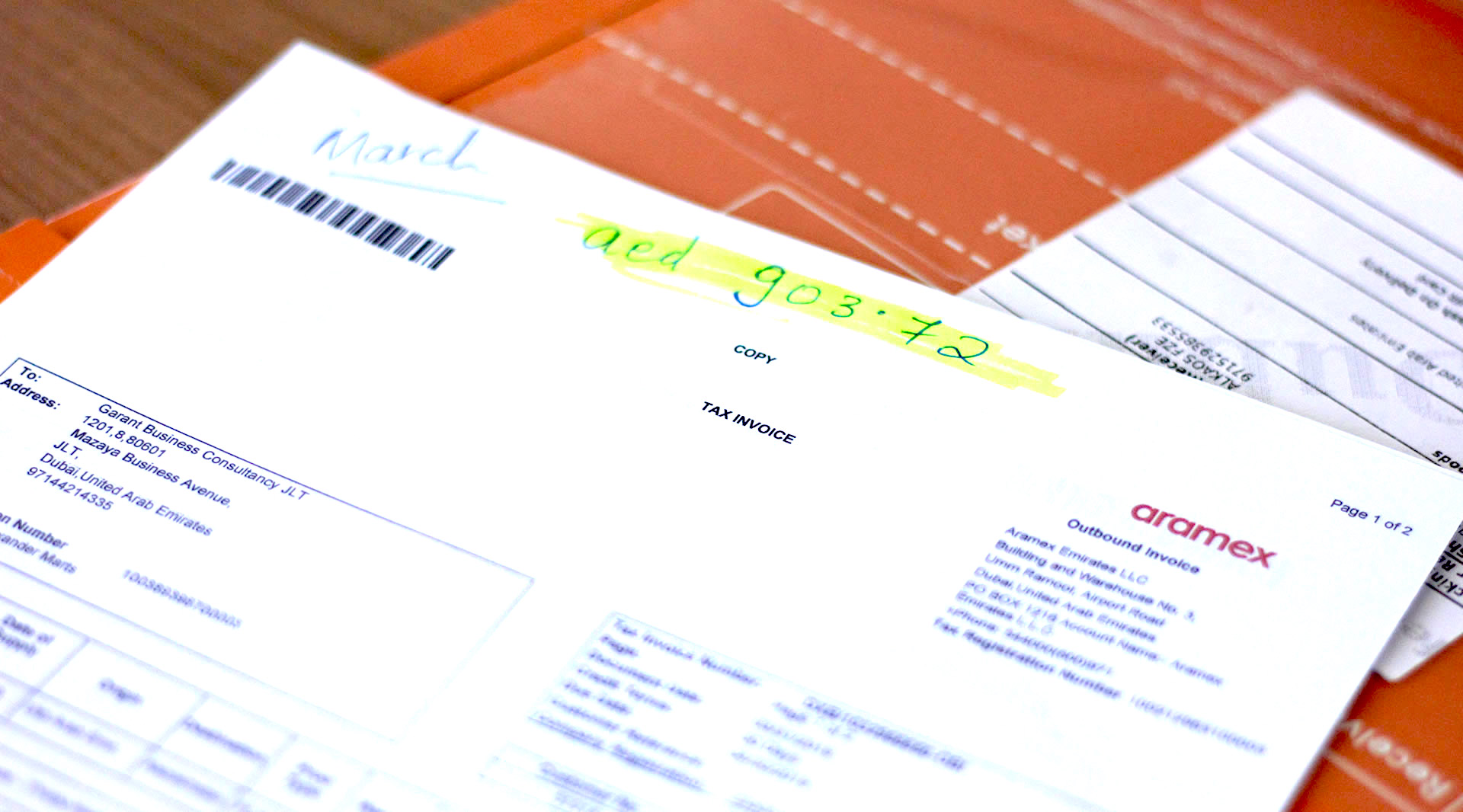

Garant Business Consultancy has a team of tax consultants and accountants who work with many clients with varied business and corporate structures and hence know the intricacies involved in the VAT accounting and VAT return preparation for different sectors.

Get in Touch

Contact Details

If you are interested in working with us, feel free

to drop us a line, we would love to hear from you.

![]() Office 1707, Tower BB-1, Mazaya Business Avenue, Jumeirah Lake Towers Dubai, UAE

Office 1707, Tower BB-1, Mazaya Business Avenue, Jumeirah Lake Towers Dubai, UAE

![]() Garant.Dubai

Garant.Dubai